Bridge the gap between legacy and modern by embracing Aiwozo Intelligent Automation.

No more spending millions to embrace digital.

Embrace Digital Workforce With Enhanced Decision Making and Compliance

Aiwozo’s Intelligent Automation suite has become critical for banking and financial institutions to achieve enterprise modernization of their outdated back-office infrastructure, and bridge the gap between legacy and modern.

- Achieve the same features and Turn Around Time (TAT) by automating on your existing IT infrastructure

- Marginal spending in automation as compared to upgrading your software landscape

- Be ready to compete and grow within a matter of weeks

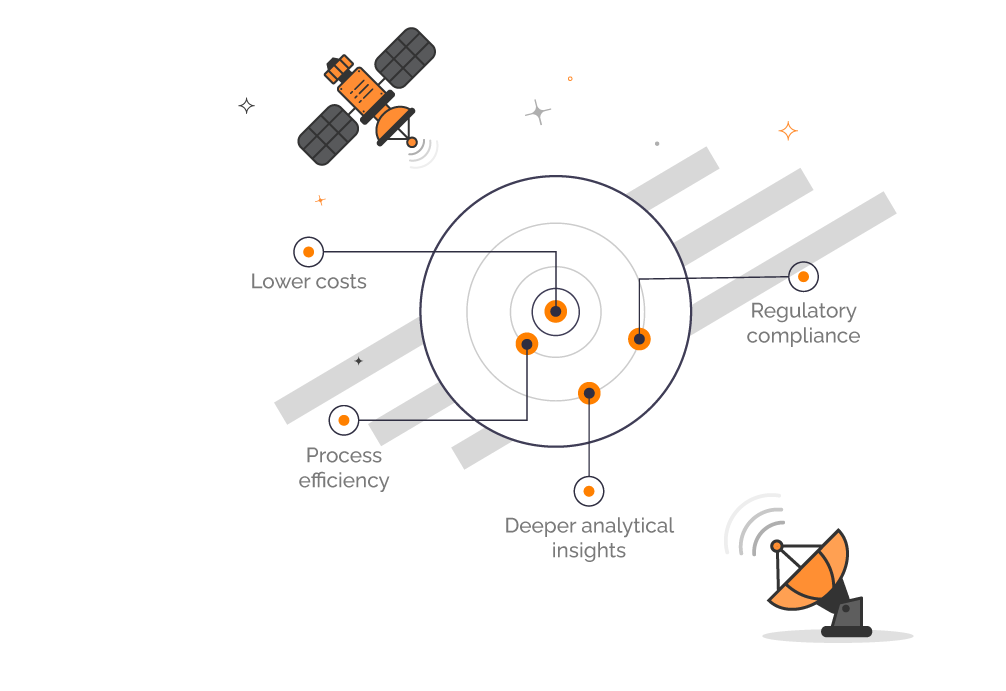

- Process efficiency with lower costs while ensuring regulatory compliance

- Deeper analytical insights with the help of Artificial Intelligent (AI)

Reduce Time to Market

Aiwozo brings to you a digital workforce with the capability of modern banking applications within a matter of weeks. Banks today are the highest spenders on moving applications from legacy to modern to keep up with the challenges of modern-day banking. Upgrading applications takes time and money. Aiwozo helps reduce your Turn Around Time (TAT) for new feature requirements, whether it stems from a need to capture a new market, or simply catch up to regulatory needs. High TAT results in challenges in growth for the financial institution.

- High TAT results in challenges in growing the portfolio. Customer satisfaction is affected adversely by the high TAT.

- Customers that are proactive about their portfolios expect a quick turnaround on changes or suggestions requested by them.

Improve Processing Accuracy

Aiwozo Bots help process transactions with improved accuracy by following rules rigorously. Losses that occur due to human error in banks include internal fraud or mistakes made during transactions. The use of standalone tools, like Excel, Access, etc, to manually process or reconcile data has been a standard for financial institutions for decades. These are responsible for managing business-critical tasks or even reporting to control functions for regulatory authorities. Over time, requirements keep changing, and operators depend on these manual processes to fill the gaps, sometimes resulting in losses of millions or even billions.

Impacts faced by financial institutions due to manual processes:

- Financial losses due to manual errors or fraud

- Inconsistency in data being compiled

- Manual tasks lack auditability and control, resulting in regulatory pressures

- Reputational impact on the financial institution

Enhance Customer Experience

Automation helps provide a consistent experience to customers. Financial institutions’ business is highly seasonal in nature, where high volumes can be seen at certain times of the month or financial year closing. Manual processes drain productivity and increase the turnaround time to reach customers, at times even losing out on potential business. Aiwozo Bots provide scalability options to handle these peak periods and ensure the customer experience is always seamless.

Aiwozo Bots help you gain new customers and also retain existing ones by:

- Improving speed and quality of responses to customers

- Leverage Omnichannel experience for customers

- Analyse data and build customized offers

- Enable Employees by providing guidance and prompts

Enhance Know Your Customer (KYC) Process

Aiwozo’s customized solutions around Know Your Customer (KYC) management helps onboard customers at a rapid speed, and at the same time, ensure regulatory compliance. KYC documents submitted by customers are classified and extracted using Aiwozo DocuBot and then verified using publicly available databases and internal flags.

Automating KYC tasks, which earlier used to take hours to now mere seconds, help protect your financial institution from a host of financial crimes, including fraud, identity theft, and money laundering.

Some of the benefits of Aiwozo’s KYC automation are:

- Reduce operational costs.

- Increase efficiency

- Reduce errors

- Increased security for digital banking customers

- Improve customer and employee experience

Success Stories

SME Loan Underwriting

Managing Check Fraud

Portfolio Suggestion

Asset Transfer

Loan Processing

Best RPA Solution — Global Artificial Intelligence Summit & Awards 2021

We’re excited to receive the award for the Best RPA Solution for Aiwozo, our Intelligent Process Automation platform, at the Global Artificial Intelligence Summit & Awards (GAISA) 2021.